|

Firstly, we must recognize the APR's meaning. The Annual Percentage Rate (APR) is the amount you must pay on borrowing from any financial institution in a single year. Annual Percentage is one of the best ways to calculate the cost of the amount that is borrowed as it involves all the costs such as the amount borrowed, closing fees, and many more. The annual percentage price (APR) is used for evaluating costs throughout diverse lenders. What is the formulation for calculating the Annual Percentage Rate? To calculate a mortgage's APR, you have to keep in mind the critical quantity, the range of years the mortgage will continue, and any extra expenses the mortgage will go through greater than the interest rate. We can use the subsequent steps to calculate ARP:

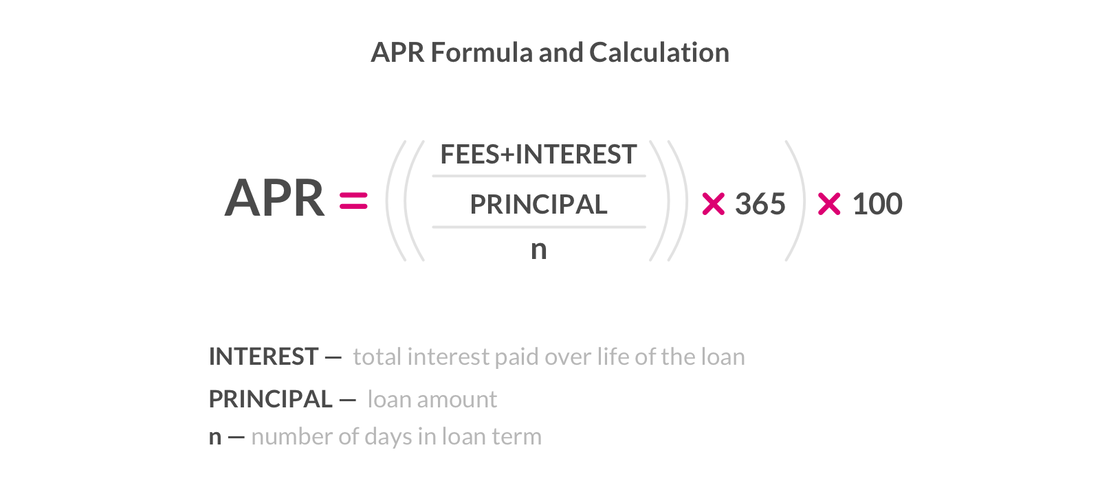

The APR Formula is: APR = ((Interest + Fees/Loan Amount)/Days in Loan Term)) x 365 x 100 APR types: Two styles of APR are: Fixed APR: The Interest Rate on Personal Loan carried out to the borrowed vital quantity no longer ranges with a hard and fast APR. You can calculate APR, and you can also fix the use of the price of interest. Because interest rates now have no more extended range, the yearly cost of borrowing cash stays constant. Variable APR: Because the interest rate carried out to the important variable varies from time to time, a variable APR is difficult to alternate. Owing to the varying nature of the mortgage, the borrower can pay extra if the interest rate rises. The annual per cent rate (APR) is the rate of interest that a borrower must pay on a mortgage every year. Read Also: What Is The Best Instant Personal Loan App In India?

0 Comments

Leave a Reply. |

AuthorAman Khanna is an experienced financial advisor who is well known for his ability to foretell the market trends as well as for his financial astuteness. He has an MBA in finance from Toronto University as well as years of experience delivering seminars on sound financial practices and debt management. |

RSS Feed

RSS Feed