|

Are manual credit card payments getting old for you? Would you like to pay your credit card bill with one click online? You can follow the instructions in this article to make credit card payments online in India. We will go over the various online payment options, their benefits and drawbacks, and how to complete the transaction with a single click.

We will also talk about the safety and security protocols in place to safeguard your credit card data when you make online purchases. Finally, we'll offer some advice on how to make wiser financial decisions and save money. So, this article is for you if you're seeking a simple, quick, and secure way to use a credit card to make a payment. How to Pay Credit Card Bill Online1. Log in to the website of your bank and select the "Credit Card" option. 2. Select "Make Payment" from the menu. 3. Choose payment via credit card. 4. Type in your credit card information. 5. Choose the payment type from the list of alternatives. 6. Type the payment amount. 7. Type your bank information and press the "Pay Now" button. 8. Verify the payment information and press the Submit button to complete the transaction. Your credit card bill has now been paid in full. Online Credit Card Payment Method As the world gets more digital, a lot of people now pay their credit card bills online. Numerous online methods for paying credit card bills have been established by lenders in response to this trend. Through Net Banking Holders of current and savings accounts must sign up for this service in order to access the net banking feature. Customers must register before making an online purchase. Following enrolment in their net banking accounts, consumers can additionally attach their credit cards. The ATM pin must be used to link the credit card to the net banking account. Through the net banking capability, clients can retrieve their credit card information and unpaid purchases for up to six months. Access the online banking system. For your credit card bill payment online, select the "credit card payment method" under the "credit card" heading. Through Mobile Banking Bills that are past due can be paid via the mobile banking app by credit card holders. Install the app on your smartphone. Then use your customer ID to log in following installation. Every feature available on the net banking platform is included. You must choose the "credit card payment option" on the "credit card" page in order to pay credit card debt. While greatly improving credit card account security, the mobile app allows customers to access their savings accounts from anywhere. Through NEFT Use the NEFT tool to pay your credit card bill from any other bank account. For this facility, the payee account number should be your credit card number. The guidelines could change a little depending on the financial institution. Weekly payments are credited on the same day if received during regular business hours. After regular business hours, payments are credited the next business day. Through RTGS If you frequently make sizable transactions with your card, you can use the RTGS option to pay all of your credit card bills at once. You can send payments of up to Rs. 2 lakh using RTGS. By making your RBL credit card bill payment on time online, you can prevent late fees from being assessed by your credit card issuer. Additionally, maintaining your credit health will increase your likelihood of obtaining credit. In conclusion, it's now simpler than ever to pay credit card bills online in India. You can complete your payment in one click with the aid of online payment portals and mobile banking applications. Additionally, you may create a monthly payment schedule to make sure payments are made on time and maintain control over your funds. You can quickly and easily pay your credit card bills using these straightforward strategies

0 Comments

CIBIL score meaning

Improving your credit score is not a one-day job. You will require a lot of patience and effort to maintain a good CIBIL score. Many factors and mistakes can affect your CIBIL score, but with a correct approach, you can increase it and maintain it for a longer run. Do you know about CIBIL score meaning? If not, then read further. CIBIL score meaning A CIBIL score is a 3-digit numeric number that ranges between 300 -900 and defines the borrower's creditworthiness. How long does it take to build the credit score? Building a high credit score is very easy for those who pay their EMIs on time and don't make common mistakes that can ruin the credit score. Building a good credit score usually takes one year. If you are not consistent in paying your pending bills and EMI's, building a good credit score can be tough. It is advised to maintain a credit score between 750- 900. Here are some important measures you can take to improve your credit score.

CIBIL score meaning is not just to get some numbers. It is to maintain your reputation and creditworthiness for hassle-free loan approvals. Read Also: Know all about your CIBIL score and report It is easy to get an instant loan in a place like Delhi. Personal loans are generally unsecured, and hence one can use them for all financial requirements. To get an instant loan in Delhi, you can look for special offers along with competitive interest rates. The unrestricted use of the loan amount makes it convenient for the user to use it for immediate expenses. Whether you want to buy a gadget or go on your foreign trip, you can use the personal loan according to your needs. Apart from that, one should also consider their eligibility criteria to get an instant personal loan in Delhi. Before choosing a personal loan, you must look forward to various factors. Some of these includes:

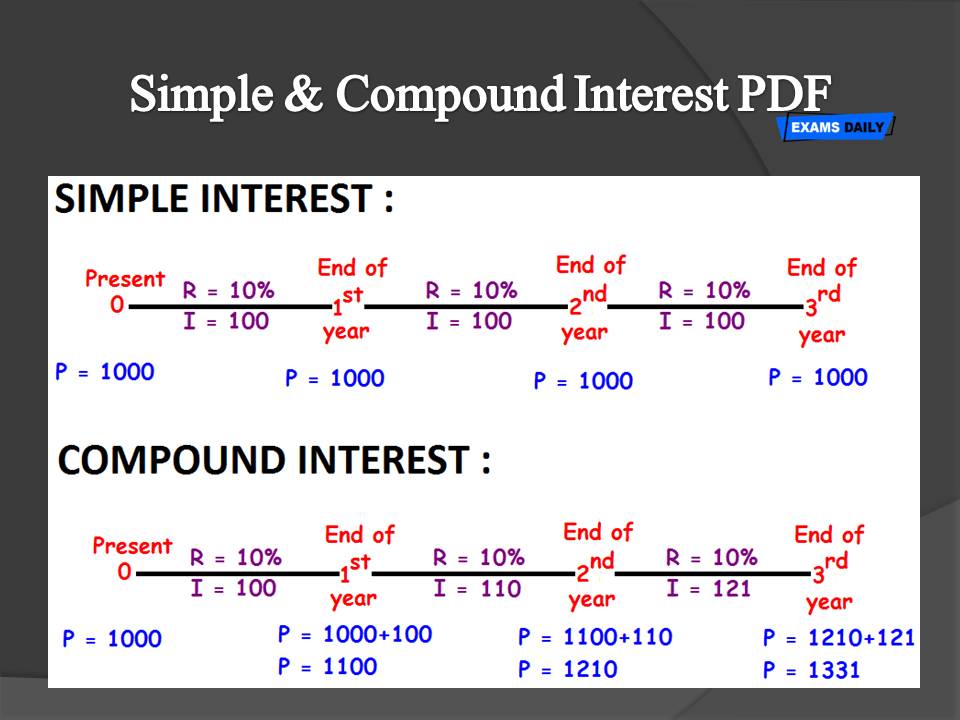

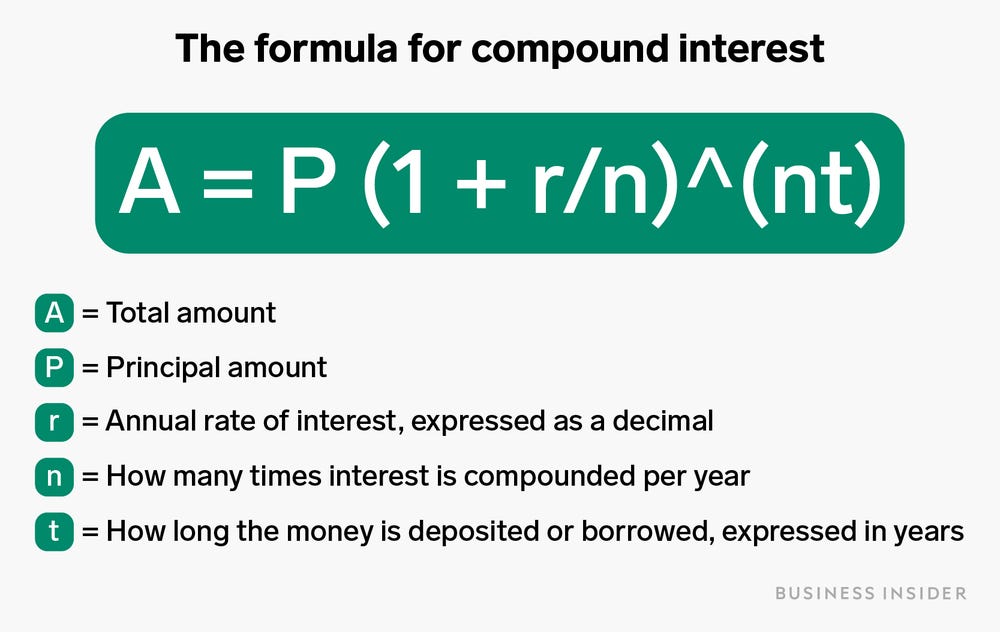

It would not require any security. A person can be easily eligible to apply for the loan amount. If you have a good credit history, you can get quick approval, and the amount can be credited within 24 hours. Read Also: Five Easy steps guide to avail a Best Personal Loans Interest refers to the cost of your borrowing money where a borrower pays the fee to a lender for their loan, and it can be in the form of a percentage or be compounded or simple. Simple Interest is based on the principal amount of a deposit or a loan. On the other hand, the Compound Interest depends on the interest and the principal amount that gets collected each period. For your convenience, we are going to state the Compound Interest and Simple Interest Formula. The formula of Simple Interest The computation of Simple Interest is done by multiplying the rate of interest for a certain period by the tenure and the principal amount. Tenure is in years, months, or days. So, you have to convert the interest before you multiply it with the tenure and the principal amount. You can use the formula given below to calculate Simple Interest. Simple Interest = P X I X N P stands for Principal, I and N refer to the interest rate of the period, and N is the tenure. Get Answers related to the KYC process, anytime and anywhere Contact Bajaj Finserv Customer Care Number. The formula of Compound Interest CI or Compound Interest gets calculated through the multiplication of one plus the interest raised to the power of the period of compounding with the principal amount. The principal amount needs to be subtracted to get the Compound Interest. The following is the formula for Compound Interest. A= P (1+r/n) ^ (n x t) – 1) Here, A is Compound Interest, P is the Principal Amount, r is the rate of interest, n refers to the compounding periods, and t stands for the duration or the number of years. We have referred to the Compound Interest and Simple Interest Formula. If you need to know the best personal loan interest rates, you can reach out to financial institutions with Bajaj Finserv. Read Also: How to Use the Compound Interest Rate Formula? Personal Loans are prevalent these days. Different rates regarding interest are imposed by different commercial banks these days. These rates fluctuate due to numerous factors. Most personal loans impose interest monthly, and some even impose this interest weekly. When we talk of APR, the total interest rate that an individual will have to pay the bank over a year is the annual percentage rate. Fixed Vs Variable Annual Percentage Rate A fixed APR is one that has its rate constant, and it doesn't vary from a change in the index. On the other hand, a variable APR is one that will vary with the change in the interest index rate. Which is better? This is a complicated decision to make. When we talk of NBFC Growth in India, the variable Annual Percentage Rate was given preference by most people. To understand this concept, one must be aware of the different benefits of this different APRs. Benefits of a Fixed APR Such an Annual Percentage Rate can give numerous benefits as mentioned-

Benefits of variable APR Variable APR also has numerous benefits-

In recent times people are switching from variable to fixed APR. The main problem out there is the sudden rise in interest these days, making variable APR very risky. Read Also: How do you calculate annual percentage rate? A personal loan can help you with various expenses. It comes with flexible repayment terms and no collateral or security. If you want to get the best personal loan, you must do some research. Before you get the loan, you must go through these easy steps.

Once you choose these easy steps, it can help you to get the best personal loan. You can also select the instant loan app to get a personal loan easily.

Read also: Reasons Why People Avail Personal Loan in India Debt consolidation is a great way to simplify your payments and potentially reduce your interest charges if you're ready to take control of your finances. You can reduce the monthly payments on your personal loan for debt consolidation. Personal loans usually have a lower interest rate than credit cards, medical loans, and other forms of debt, especially if your credit is good or excellent. You won't have to worry about coordinating payments to third-party creditors since many lenders offer direct payments to third parties. Some personal loan for debt consolidation that offers low-interest rates and flexible repayment terms and avoids fees like prepayment penalties are the best choice. This allows you to discharge debt early without paying any penalties. Debt consolidation loans Individuals may consolidate their debt by taking out new pre-approved loan offers to pay off other obligations and consumer debts. A combination of several debts is usually restructured into one, larger debt, such as a loan, with better payoff terms, such as a lower interest rate or lower monthly payment. Students, credit card holders, and other lenders can use debt consolidation to reduce their liabilities. Debt consolidation loans come in many forms, including traditional emergency loans from banks and peer-to-peer loans that help borrowers manage large amounts of debt. They are specifically designed for individuals who want to pay off multiple high-interest debts at once. Debt consolidation through Bajaj Finserv As a borrower, you can avail of a loan of up to Rs. 25 lakhs through a Bajaj Finserv Personal Loan for Debt Consolidation. In addition to pre-approved offers, the lender offers customers a flexible repayment tenor. The process to get a personal loan:

Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read Also: Everything You Should Know About the Types of Personal Loan KYC is also called "Know your Customer" and is an essential process carried out by India's banks and other financial institutes. KYC documentation may include different identities such as the Aadhaar card, Permanent Account Number, and also other residential proofs. Other essential documents are submitted in the process by the customer in the banks, which enables them to know their customer and further help them out with their unique plans accordingly. Why is KYC so Important? These days you cannot communicate and open a savings or current account with the national banks if you don't have your KYC done.

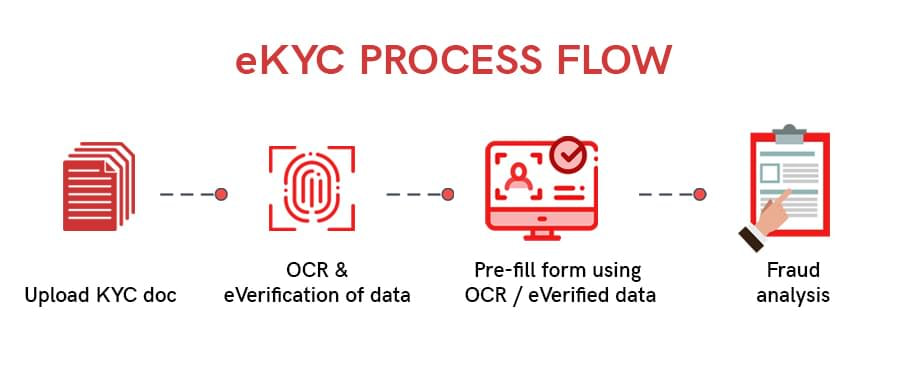

E-KYC These days, the world is dependent on technology and the virtual world of the internet for most of the work. Even banking has become very easy with the advancement in technology. With the development of e-KYC verification online banking methods, things have become very easy. The benefits of e-KYC

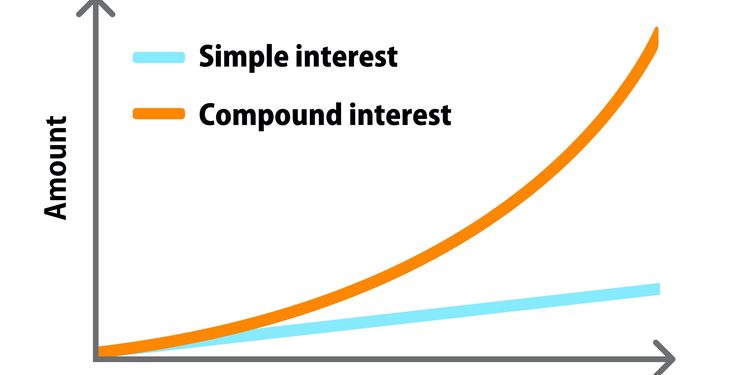

Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read Also: Co-Borrower vs. Co-Signer, Which One Should be Used? A co-signer or co-borrower may be an option when applying for a loan. Co-borrowers are considered to be the most beneficial because they share ownership of the loan assets and are responsible for the payments right from the beginning. On the other hand, a co-signer does not own the collateral that's connected to the loan; he or she is liable only if the primary borrower fails to pay it back. Read on for more information on co-signer vs. co-borrower. Why choose a Co-Signer If a primary borrower does not pay back a Low-Interest Personal Loan, a co-signer will take responsibility for repayment. In most cases, the co-signer has stronger credit or a higher income than the primary borrower, which could prevent the loan application from being approved without one. Usually, co-signers and the primary borrower share a close relationship. Co-signers are typically parents, spouses or other family members. How co-signers work Co-signers act as guarantors for the primary borrower. In the event that the borrower doesn't repay the loan as agreed, the co-signer will assume responsibility; otherwise, payment is the borrower's responsibility. Downside The co-signer takes on the same type of financial risk as the co-borrower. In the case of a default by the primary borrower, the co-signer is legally required to pay off the outstanding debt. Best time to select a co-signers When only one of the borrowers benefits from the loan and the primary borrower agrees to make repayments on their own, cosigning is typically preferred. Those with low incomes or students without credit may consider it. Co-borrower Co-borrowers sometimes referred to as co-applicants, share the responsibility for repaying a loan with another party. For instance, if you borrow a Best Personal Loan with instant approval, you are reassured by the lender that you can repay the loan with multiple income sources. Loan amounts are normally larger for applicants with co-borrowers since they pose less of a risk to lenders. How co-borrowers work Along with the responsibility to repay the loan, both co-borrowers may own assets that guarantee the loan, such as a house or car. Downsides Co-borrowers are responsible for repayment at the outset of a loan, which is the biggest risk. Both co-borrowers will be affected if one borrower's actions have a negative effect on the loan. Best time to select a co-borrower There is generally a preference for cosigning if the loan will benefit only one borrower, and the loan will be repaid by the primary borrower. Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read Also: Keep These Things in Mind While Taking a Instant Loan in Surat The compounding concept is advantageous for lending and borrowing in the financial sector. Simple and other advanced formulae such as the compound interest rate formula are mainly used by banks/financial participants to determine interest liability or income. What does compound interest mean? The compound interest of a financial asset is interest over interest. Here is an example to clarify this concept or the compound interest rate formula. With an annual compounding repo rate of 10%, you have deposited Rs. 1000 over 2 years. To explain this, imagine calculating the interest on Rs. 1000 with a 10% rate of interest so that you will earn Rs. 100 on Rs. 1000 for the first year. (Deposit plus interest) Rs. 1,100 would be the principal amount for the second year. There would be Rs. 110 in interest for the second year. Here is an example of compound interest, which shows an interest of Rs 100 earned on a deposited amount and then Rs. 10 was earned on the interest of Rs. 100 that was previously earned. What are the methods of calculating? It would help if you use the following formulas to determine this interest: 1. First, determine the accumulated amount for the overall period, which is the sum of deposited amounts and interest earned. Accumulated amount= Principal amount [1+annual interest rate] ^ time 2. Then, interest can be calculated using the following formula: Compound interest=Accumulated amount - Principal amount Advantages of Compound Interest It is more advantageous than simple interest because it provides access to earning interest on previously earned interest. In loans, it increases the value of loans, resulting in an advantage for lending firms. Lenders and financiers compute interest values and future money values throughout the financial industry using the compounding method. Take another example, for instance. You'll receive interest on your deposits in a savings account or similar account when you deposit money. You would receive Rs 50 in interest after a year by putting Rs 1,000 into an account paying 5 percent interest. You earn compound interest when you earn interest on interest. Therefore, in the example above, you would earn 5 percent of Rs 1050 in interest payments in year two, or Rs 52.5. Compound interest allows your savings to quickly grow because it accelerates the interest earnings. As the account balance increases thanks to the interest earned in prior years, you'll earn interest on larger and larger amounts. Your interest earnings can snowball very quickly if you use compound interest over the long run, and it can help you build wealth. Investments and savings accounts, as well as money market accounts, pay interest. The interest payable on an investment or a savings account is determined according to a period- daily, monthly, every six months, or even a year. You'll earn additional interest on your deposits in these accounts, compounding the interest you earn. Interest compounds according to the account's schedule. Interest might be compounded daily, weekly, or monthly in a basic saving account. Read Also: Keep These Things in Mind While Taking a Instant Loan in Surat When you need funds, getting a personal loan is often the wisest course of action that will allow you to get back on your feet and thrive. Personal loans in Surat can be obtained with ease and achieve long-term savings with no requirement for collateral. Loan with the Lowest Interest Rate A personal loan in surat is unsecured, and it's not uncommon to be charged an interest rate as high as 20% or more. When applying, always look for the lowest possible interest rate and consider other options such as using credit cards. It's easy to find the lowest personal loan rates online. A slight difference in interest rates would mean a lot less monthly cost for you, your family, and the business. Banks and lending institutions base their decisions on several factors like how reliable your income is physically, the age of the loan-recipient and other financial information such as credit score. Check the Other Charges Although interest rates are essential, the processing fee needs to be considered. The processing fee is between 2-4% of the loan. Sometimes, banks come up with discounts on their processing fee. It's also important to consider the pre-payment penalty, while applying for a loan. These are calculated on a percentage of the outstanding amount. Avoid Gimmicky Offers You may be offered different types of Instant loan in surat, and lenders may claim to provide you with a high loan amount as well as an easy disbursement. It is best to learn the basics about personal loans and check if your needs match these lenders' offers. But some may not provide the benefit you expected after making your decision. Make sure you read through the terms of the loan before agreeing on it. Conclusion Here are a few things to keep in mind if you opt to take personal loans in Surat. Different types of loans can help you survive an unexpected financial crunch, but none is as beneficial as a personal loan. These loans are available without any collateral or credit check. Read Also: Dos and Don’ts that Influence the Interest Rate of your Personal Loan Small loans can help one execute emergent needs without incurring a high burden afterward. But before applying for these kinds of loans, you must calculate the monthly EMI, to know exactly what you are getting yourself into. This can be done manually, or you can use an online personal loan calculator, which would prove to be fast and accurate. All you need to do is select your interest rate, the amount of loan, and the tenor, which will help you get the exact payable amount of EMI. When one applies for small personal loans, one must pay monthly payments of the EMI. This affects one's monthly expenditure but can also help smoothen your monthly transactions if managed efficiently. It is prudent to negotiate with a diverse loan provider when looking for a personal loan. Get a lender who provides you with lower interest rates. In addition, you must maintain a CIBIL score. A better CIBIL score can assist you in obtaining a loan with a reduced interest rate. The monthly EMI will be reduced as a result. Furthermore, the borrower should constantly look for the finest offer and match their requirements and tastes. Aside from that, repaying capacity is quite important. If you have the financial means to repay the loan promptly, you may borrow a large sum, but the EMI of a personal loan is affected by several circumstances. The monthly installment payments are precisely proportionate to the loan amount you take out. You'll have more outstanding EMIs if you take out a larger loan. The interest rate increases the EMI. The tenor time is equally important in determining the EMI for any personal loan. If you can boost it across the board, you may receive a lower monthly payment. When you borrow money from a lender, you may use the personal loan rate of interest calculator to determine the interest rate. After choosing the appropriate loan amount, interest rate, and payback duration, you must submit this information online to get the precise amount due. Furthermore, employing a rate of interest calculator can allow you to compare interest rates from different lenders. It also saves you time when doing an online computation. With the online EMI calculator, you can easily verify your payback plan. Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read Also: Avoid These Mistakes While Applying for an Instant Personal Loan The concepts of simple interest and compound interest could confuse you if you aren’t aware of the finer details. Let's look at the differences, including the compound interest rate formula. The simple interest rate is calculated annually on the initial principal amount alone for the entire period. When you calculate compound interest using the compound interest rate formula, you combine both the principal and the previous interest. An initial principal of Rs. 100 with a simple interest of 10% per year for 5 years would result in a simple interest rate of Rs. 10 per year, with a total amount after 5 years of Rs. 150. As an alternative, compounding at the same rate after 5 years will result in a total of about Rs. 161. The interest after the 1st year is calculated on Rs. 10. After the second year, the compound interest will be calculated on Rs. 110 instead of Rs. 100, and so on until the loan is paid off. For that same interest rate and principal amount, the amount will be higher after 5 years if compounded. How to calculate Simple interest is the interest you pay on a principal amount you borrow SI = P (Principal amount) × R (Rate of Interest) × T (Time) Compound Interest is the interest on the principal added to the unpaid interest P (Principal Amount) (1+r/n) > (nt) In this formula, n 'refers to number of instances when interest is applied', r 'refers to the interest rate', and t 'refers to the tenor or time'. Uses of simple interest

Uses of compound interest

Read Also: What is annual percentage rate and how to calculate it? Read Also: What are the Differences Between Simple Interest and Compound Interest? Obtaining a pre-owned car loan through licensed institutions may necessitate a significant amount of documentation and effort. Many tiny smartphone application-based firms, on the other hand, are already giving loans in a matter of hours and with no paperwork. This implies you may obtain immediate cash worth thousands of rupees without losing precious 'time'. However, many cash-offering mobile applications demand exorbitant interest charges and, therefore, cannot be fully trustworthy as real lenders. Checklist of factors Google has deleted over 100 private loan applications that violated the safety of its consumers. These applications reportedly demanded exorbitant interest rates, gathered personal information, and exploited it for illegal purposes. Therefore, if you want to borrow more money via instant mobile applications, the ideal approach might be to firstly check these apps. Purchasing a used automobile is not uncommon. You may accomplish this by applying for a pre owned car loan through an authorized application. Verify your creditor: Before asking for a loan, search online to check out whether or not the Reserve Bank licenses the firm. Businesses controlled by the RBI are required to obey legal rules and adhere to a specific code of ethics, and you need to ensure that the service provider which you seek is legal and follows the mandated code of ethics. Website validation: If a website looks suspicious or does not have a security certificate, do not open the website. Even though the webpage is recognized, always look for 'HTTPS' within the link. A trustworthy lender will generally ensure that the link to their webpage is safe and also that their information is protected from cyber thieves who steal information. Examine the real address: Each lender must possess a physical location, contact information, and also an email account. If you don't locate any one of this information, it really is a warning signal that it is a bogus loan application. Interest rates: When requesting any online personal loan, always verify the borrowing costs and the late pricing structure. When the creditor is not transparent about the loan rate sum and grants the offer without verifying your credit ratings, this is most probably a fraud. Examine online reviews: Look for feedback from the firm on the android store to obtain a sense of where you’re entering into. Search for reputable sources and read their assessment regarding the loan app. Conclusion Borrowers must always set a secure password when opening a profile inside the loan application, in addition to the safety recommendations listed above. It will protect your personal information from internet attacks. Make a password that is not associated with any of the social networks. Keep the complexity level high by using a combination of digits, capital, and lowercase characters to produce a passcode that really is tough to crack. Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read Also: Five Smart Ways to Avail of An Emergency Loan During Financial Needs A personal loan is a form of credit typically issued to individuals. It is typically unsecured, which means that there is no collateral or asset offered as security for the loan. Lenders might look at your employment status, income, and CIBIL score before approving you of a Best personal loan. Remember to make sure you meet the criteria! Get access to your funds without risking your assets. With instant personal loans, you can borrow money without any collateral, just like an unsecured loan. Whether you need to address your current needs or take care of upcoming ones, they can be quite beneficial. These loans offer various amounts for different purposes and repayment periods that suit everyone's needs. Get a high-value sanction. Understanding that costs of higher education, a wedding, or medical treatment can be quite high. To serve your financial need, reputed lenders in India often provide up to Rs. 25 lakh of instant personal loans, so you can get the important things you need to be done without a financial burden on your family. Low-interest loan offers It's smart to know which lenders have the best seasonal offers on personal loans during the festive season or for other purposes and occasions. It can help you save on interest and choose from different demand-driven offers. Pocket-friendly EMIs Financial institutions usually offer a convenient repayment period on personal loans for salaried employees. Some people choose to get a tenor of up to 60 months, which gives them plenty of time to ensure their monthly installments fit their budget. You can better plan your finances with a personal loan calculator online. Computation is much easier when you use these calculators, and managing your finances can be done in advance. Easy access to loans online & by using an approved offer People don't always have the time to go out and queue for a loan anymore. Moreover, people hate spending time going to the bank. There's an easy solution with personal loans available digitally from the convenience of your home. Fill out the form and submit them for instant online approval, with or without having to visit a branch. Conclusion Aside from a wide variety of repayment options, you're also able to get a personal loan with a nominal interest rate and various benefits, such as application & approval is easy. Give your life the boost it needs; apply for an instant personal loan today. Stay Tuned with Finance Affairs for more Finance and Loan Blogs. Read More: Five Smart Ways to Avail of An Emergency Loan During Financial Needs Recently the concept of eKYC has been doing the rounds. But what is KYC? It is a process of identification that helps the various authorities to know their customers. The need for identification has increased due to the various kinds of scams and frauds that are going around. The concept of e KYC gets applied to various sectors. But especially in sensitive sectors like those related to financial wealth, and investment indulges in electronic know your customer. Evolution of KYC The procedure helps to identify and verify the customer's identity. This process includes a series of checks that helps the institution to verify its client. But due to the various series of rules and regulations, one experiences a lot of hindrance in the process. Hence, with time, one could go for KYC practice both offline and online. Digital transformation Every economic agent and business, especially those related to finance, is going through digitization. In the last decade, every organization has experienced a part of the transformation with digitization. Various organizations and companies are looking forward to this process to indulge in remote operation. With the help of cutting-edge technology, including machine learning and artificial intelligence, one can transform their business while optimizing the whole process. With the help of the eKYC process, the organizations can somehow reduce the cost and bureaucracy. It is based on machine learning and artificial intelligence that help companies comply with current regulations. It also offers the highest level of security. However, the paper trials happen to be quite expensive and slow. It can also tend to make errors. These can be a perfect hiding place for tax evasion and corruption. With the help of the eKYC process, the transparency and speed of the digital process offer a great experience to the customer while preventing any abuse in the transaction process. Moreover, if you want to create an effective electronic KYC regime, you need to inculcate the elements for checking, very fine, and analyzing in an electric method. Read Also: CAMS Launches eKYC Using OTP Based Aadhaar Verification Home renovation loan offers an alternative financing option for home improvement projects. Different house renovation loans depend on your budget and intended use of the money. It is important to understand the advantages and disadvantages of each type of loan. Depending on your preferred application, these loans can be secured for 3 to 10 years with a fixed interest rate or remain unsecured. A home renovation loan can help you achieve your dreams. As a homeowner, you have a lot of goals and dreams. You've likely been saving up for a while now to pay for those goals. The easier (and often, faster) way, is to go a home improvement loan from your bank. But what if you wanted to renovate your entire house and not just one room? Or maybe you wanted to redo the kitchen or replace the roof? The truth is that these types of projects can be costly and time-consuming. Financing options

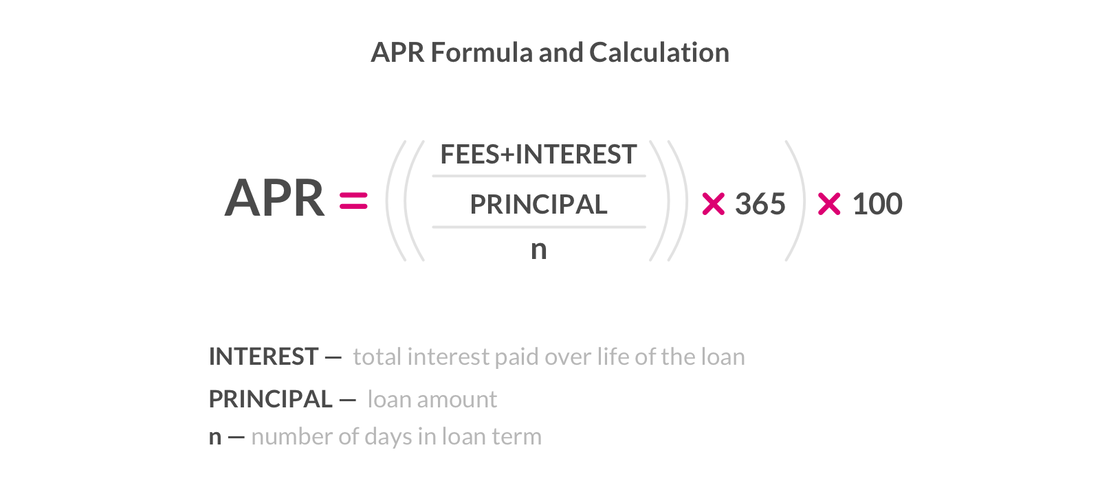

Conclusion Most people will want to borrow as much as they can from their savings. However, sometimes, it becomes difficult to borrow more money. You can get cash by taking out a top-up loan and making quick cash when you need it the most. Home renovation loans are a good way for people to renovate their homes cost-effectively. You can avoid taking out a mortgage or paying rent. It is also an opportunity to live in your dream house, without worrying about the burden of high monthly payments. Read Also: Factors to Consider While Availing of a Home Improvement Loan Private loans are useful in times of need and financial difficulty. These could be obtained with minimal documentation and without the need for security. With several financial institutions and NBFCs actively promoting quick private loans, obtaining a private loan authorized feels like a kid's game. Therefore, when you request for this, there may be various eligibility restrictions, rules, and limitations that financial companies do not reveal upfront, resulting in delayed credit processing. Many people can get tax benefit on personal loans. Certain basic procedure However, we have compiled a list of four helpful ideas that might make obtaining a private loan a breeze. Improve your credit rating- A commonly stated remark needs repeating: a strong credit rating is required for whatever type of borrowing you wish to obtain. A bad credit history indicates that you are likely to skip in upcoming loan payments. As a result, if you possess a poor credit history, you must boost this before asking for a private loan. Your tax benefit depends on your personal loans. Evaluate your financial capability- Requesting a credit sum which you may be unable to return will result in your request being rejected. The creditor will always analyze your payback capacities depending on your monthly salary before granting a credit. There are several estimators available online. Anyone can utilize the credit eligibility estimator to evaluate their status. To avoid embarrassment, it is vital to understand your criteria before asking for a credit. Keep the essential documents on hand- Owing of the availability of the Aadhaar card plus digitization, bankers do not require a lengthy list of paperwork to complete the personal loan for salaried employees. The paperwork procedure has grown much more convenient and straightforward in recent years. However, you must apply extreme caution because appropriate documentation ensures that your credit is granted swiftly. Check your papers again before submitting them to prevent any delays in loan approvals. Have a steady job- Check to see whether you possess any job stability and how you have been performing in your present business for the last 6 months. Such requirement is especially crucial in the event of an unprotected loan, in which no security is used to secure the cash. As a result, banks are more likely to lend to people with at least two years of employment and above, since it assures a consistent monthly income. Conclusion You must be both cautious and patient when filling out your loan request. It's a vital scenario, so make sure you meet all the bank's requirements and also do not give them any reason to doubt you. Always learn about tax benefits on personal loans. Read Also: Everything You Need to Check for a Personal Loan for Students Firstly, we must recognize the APR's meaning. The Annual Percentage Rate (APR) is the amount you must pay on borrowing from any financial institution in a single year. Annual Percentage is one of the best ways to calculate the cost of the amount that is borrowed as it involves all the costs such as the amount borrowed, closing fees, and many more. The annual percentage price (APR) is used for evaluating costs throughout diverse lenders. What is the formulation for calculating the Annual Percentage Rate? To calculate a mortgage's APR, you have to keep in mind the critical quantity, the range of years the mortgage will continue, and any extra expenses the mortgage will go through greater than the interest rate. We can use the subsequent steps to calculate ARP:

The APR Formula is: APR = ((Interest + Fees/Loan Amount)/Days in Loan Term)) x 365 x 100 APR types: Two styles of APR are: Fixed APR: The Interest Rate on Personal Loan carried out to the borrowed vital quantity no longer ranges with a hard and fast APR. You can calculate APR, and you can also fix the use of the price of interest. Because interest rates now have no more extended range, the yearly cost of borrowing cash stays constant. Variable APR: Because the interest rate carried out to the important variable varies from time to time, a variable APR is difficult to alternate. Owing to the varying nature of the mortgage, the borrower can pay extra if the interest rate rises. The annual per cent rate (APR) is the rate of interest that a borrower must pay on a mortgage every year. Read Also: What Is The Best Instant Personal Loan App In India? You buy money in the form of a loan with interest. So how much extra money you have to spend, depends on the rate of interest. A good lending company offers you the option of selecting between a fixed interest rate and a floating interest rate. You have to weigh the fixed interest rate vs floating interest rate. It is very important to select between fixed and floating interest rates. The reasons are:

What is a fixed interest rate?

What is a floating interest rate?

Steps to follow while calculating EMI on personal loan 1st Step: Visit the website of the lender and open an Online EMI Calculator for Personal Loan. 2nd Step: Enter your loan amount, tenor, and agreed-on interest rate. 3rd Step: Click on ‘calculate’ and you will get the answer. You may read the monthly installments, total interest payable, and the total amount payable in seconds. Conclusion Nowadays, getting a personal loan has become easy. A trustworthy leading lending company like Bajaj Finserv will explain to you the fixed interest rate vs floating interest rate when you approach them for your loan requirement. You can open the personal loan EMI calculator on the website to know your loan status. Read Also: Easy Tips to Improve Your Chances of Getting an Online Personal Loan

The first that comes to mind when planning to apply for a personal loan is the interest rate. Considering a loan that you can use for multiple purposes, a personal loan is the best choice for all. With the availability of personal loan for women, there has been a change in developmental opportunities.

But the question that remains is how to calculate the EMI? Well, the best option is to use the personal loan calculator. Loaded with simple to use features, the calculator can help the borrower have a brief idea about the personal loan EMIs in advance. How can you use the personal loan calculator? Well, for that, the borrower is required to feed some basic information like loan amount, tenor, and interest rate. The calculator then displays the total payment, the EMI, and the final amount for the personal loan interest payable. Being simple to use, the calculator can find the best personal loan for women in no time. Using the personal loan calculator, the borrower can get the most cost-effective choices by just modifying the tenor and loan value that can help plan finances better. Also, it allows one to locate the finest personal loans based on the lowest interest rate and the longest term. The uses of personal loan calculator Based on the features, there are multiple uses of the Personal Loan EMI Calculator Online. The most important ones are as follows:

While there are various personal loan options, it is important to compare and contrast each to get the best result. Using the personal loan calculator offered by NBFCs like Bajaj Finserv allows the comprehensive analysis and understanding of the loan aspects which is important for better financial management.

Are you buying a second hand car? Check the lowest interest rates on used vehicle loans here12/24/2021 Owning a car is the wish of each of us, but often we can't get our desired one due to inadequate funds. But your worry ends here because you can fulfill this desire by taking second hand car loans. Moreover, you can get these all over the country at a low-interest rate. So getting a used car on loan can be a perfect way to save your money. Some people hesitate to get second hand car loan as they are afraid of interest that can increase late payments. We have a list where you folks can check the low-interest personal loans for vehicles. Buyers can get information and decide which car they can get with a percentage chart of interest. You can avail your desired car at a meagre interest rate from here. Leading lenders provide a beautiful chart to the customers that can help them to own a car. They can finance you with a high-value used car with ease. You can visit their website and follow the easy and simple steps to help you attain your dream car. They will also provide you with a doorstep facility that will increase your comfort. As an alternative, you can also apply for a personal loan and get instant approval within minutes, and once your documents are verified, your loan will be disbursed in the next 24 hours. Also, it provides you with the flexibility to borrow the funds when required, and you can prepay whenever you have adequate funds to do so. With a personal loan, you have to submit just a few documents and also avail yourself of the flexible personal loan repayment facility that reduces the burden on your monthly budget. For hassle-free financing, you can apply for a personal loan with Bajaj Finserv and get instant approval with just a handful of documents. Read Also: Avoid These Mistakes While Applying for an Instant Personal Loan Today's education system wants more investment. Parents are looking for better education for their children and receive quality qualifications, so they invest their real money for that. But this is not affordable for some parents. So they avail the of personal loan for students.

The government aims to help all students pursue their dream. So through the Vidyalakshmi education loan, they give a bright opportunity for lower-income and middle-class families. They take a loan then, after following their goal, they pay it to the bank. You can take a loan for higher education of up to Rs.25 lakh. The Requirements to get a personal loan for students is:

You can also avail of quick loans, and it fulfills our easy-to-meet eligibility parameters; you can quickly get only the basic documentation process. And you get the money that you need. You only have to pay 45% lower EMI. Individuals can borrow money for their higher education. The steps taken to take quick loans are:

Follow these steps, and you get a quick loan. It's the best way of availing a personal loan for students. Taking an education loan is a very stressful thing. But now you have to get a quick loan amount for minimal documents. Bajaj Finserv provides you with a hassle-free personal loan with minimal paperwork. With its easy online application, you can get instant approval on your loan and have funds transferred into your bank account in just 24 hours. This NBFC also provides pre-approved personal loan offers to expedite your loan processing and can be availed by simply sharing your basic details. Non-Banking Finance Companies (NBFCs) are organizations that provide services such as loans and advances. They are different from banks as they don’t offer savings accounts and operate by a distinct set of rules and regulations.

There are several different types of NBFCs in India that emerged as bank alternatives for those who want quick access to funds. These companies often help meet credit demands not fulfilled by banks which is why they are gaining popularity. Some of the simple reasons behind the growth of NBFCs in India are quick sanctions, simple terms, easy repayment structures, and more. Types of NBFCs in India There are two primary types of NBFCs in India. Deposit-Accepting Such financial companies accept deposits from the public. They are investment companies or asset management companies or others. Non-Deposit Accepting These NBFCs are companies that don’t accept deposits from users. They can only lend money and accept repayments. What are the Roles of NBFCs? NBFCs often offer customized products and solutions to meet the varying needs of users. This way, they play an important role in promoting the nation’s growth. You can use online tools to understand how lenders calculate interest payments. The compound interest rate formula is applied to give you the total repayment amount and EMI payment. NBFCs are blessings for new businesses with no credit history and individuals with a low credit score. They help create employment, thus playing a role in the country’s development. They also help build financial strength by lending to Micro, Small and Medium-scale businesses. List of Top NBFCs in India in 2022 There is a large number of Non-banking financial companies already active in India. Here are some of the top players in the industry.

Calculating the payable interest amount before applying for any type of personal loan is a wise move. By doing so, you will be helping yourself with a better repayment strategy. You can easily find out personal loan interest regardless of applying online or visiting your lender.

Let us see how to find out personal loan interest: Before we start, let us learn about some of the standard terms that you will need to know before calculating the interest amount. CIBIL credit score This score proves your creditworthiness which is highly influenced by your past repayment activities. Having a credit score above 750 is considered suitable for any type of personal loan like wedding loan, business expansion loan, etc. Loan amount For any type of personal loan, the principal amount defines the interest rate for repayment. Repayment Tenor When you opt for a lower tenor, your interest amount decreases, it is valid for all kinds of personal loans, including the wedding loan. How to calculate the interest loan amount Here we will be using the following formula: Formula: The formula for finding the interest rate: I/Pt = r Here, "I" refers to the amount of interest that you need to pay within a predefined term. "P" refers to the principal amount of the loan. "t" refers to the free defined term duration in the loan agreement. "r" refers to the value of interest rate in the decimal form. Multiply the result by 100. Also, the formula for specific period interest amount: I = Prt Using the above formula, you can quickly determine the interest rate for any type of personal loan. However, it would be more feasible to use an online loan calculator. You can find the calculator on the official website of your lender and use it free of cost. Check out with one of the leading NBFCs like Bajaj Finserv to get access to hassle-free personal loans and get funds up to Rs.25 lakh with minimal paperwork. This NBFC also provide pre-approved loan offers to make the processing faster and easier for their customers. |

AuthorAman Khanna is an experienced financial advisor who is well known for his ability to foretell the market trends as well as for his financial astuteness. He has an MBA in finance from Toronto University as well as years of experience delivering seminars on sound financial practices and debt management. |

RSS Feed

RSS Feed